A moving average is a technical indicator that generates a single trend line by aggregating the price points of an instrument over a specified time period and dividing by the number of data points. It is popular among traders since it may assist in determining the current trend’s direction while also reducing the influence of random price surges.

By analyzing the historical movement of an asset’s price, a moving average will allow you to assess the levels of support and resistance. It’s a measure of change that tracks an asset’s prior price activity, analyzing market moves in the past to predict future patterns. Because a moving average is generally a lagging indicator, it is one of the most often used technical analysis tools.

A specific amount of data is required to calculate an MA, which might be a huge amount depending on the duration of the moving average. A ten-day MA, for example, will require ten days of data, whereas a one-year MA will require 365 days. Because the introduction of fresh numbers will replace previous data points and move’ the line on the chart, the moving average indicator is defined as moving.’

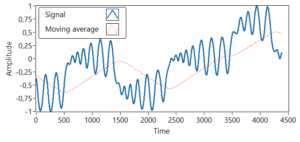

Example of Moving Average

Simple moving averages and exponential moving averages are the two primary types of moving averages.

The simplest basic MA is a simple moving average (SMA), which is just a computation of the mean price of a collection of data across a set of periods. If you wanted to calculate the SMA for ten days, you would divide the numbers from the previous 10 days by ten.

Let’s pretend that an asset’s previous 10 data points were 80, 81, 82, 80, 82, 89, 82, 82, and 83. The moving average would sum these numbers and divide by 10, yielding an average of 82.2.

The exponential moving average is the second type of MA, which emphasizes recent prices to make the data more sensitive to fresh information.

The computations for moving averages are usually done automatically by most trading systems. Moving averages, as well as other technical tools like Bollinger bands and RSI, are available on our charts with IG. To utilize them, go to the top of the chart and click the ‘indicators’ symbol, then pick a moving average.

Simple Moving Average Calculation

A simple moving average is calculated by taking the average price of a securities over a set number of periods. The majority of moving averages are calculated using closing prices; for instance, a 5-day simple moving average is calculated by dividing the five-day sum of closing prices by five. A moving average is, as the name implies, a moving average. As new data becomes available, old data is discarded, causing the average to vary over time. The sample below demonstrates the evolution of a 5-day moving average over three days.

- Daily Closing Prices: 11,12,13,14,15,16,17

- First day of 5-day SMA: (11 + 12 + 13 + 14 + 15) / 5 = 13

- Second day of 5-day SMA: (12 + 13 + 14 + 15 + 16) / 5 = 14

- Third day of 5-day SMA: (13 + 14 + 15 + 16 + 17) / 5 = 15

The moving average’s initial day merely covers the previous five days. The moving average’s second day subtracts the first data point (11) and adds the new data point (16). The third day of the moving average continues with the initial data point (12) being removed and a new data point being added (17).

Prices progressively climb from 11 to 17 in the example above over the course of seven days. Over a three-day computation period, the moving average also climbs from 13 to 15. Also, each moving average value is somewhat lower than the previous price. For example, the first day’s moving average is 13 and the most recent price is 15. Prices were lower over the previous four days, causing the moving average to lag.

Exponential Moving Average Calculation

Exponential moving averages (EMAs) minimize latency by giving current values greater weight. The number of periods in the moving average determines the weighting applied to the most recent price. EMAs vary from conventional moving averages in that the EMA calculation for a current day is based on the EMA computations for all previous days. To compute a somewhat accurate 10-day EMA, you’ll need significantly more than 10 days of data.

In three phases, an exponential moving average is computed (EMA). Calculate the initial EMA value’s simple moving average first. Because an exponential moving average (EMA) must start somewhere, the first computation employs a simple moving average as the EMA from the prior period. Calculate the weighting multiplier second. Third, using the price, the multiplier, and the preceding period’s EMA value, compute the exponential moving average for each day between the original EMA value and today. For a 10-day EMA, use the calculation below.

- Initial SMA: 10-period sum / 10

- Multiplier: (2 / (Time periods + 1) ) = (2 / (10 + 1) ) = 0.1818 (18.18%)

- EMA: {Close – EMA(previous day)} x multiplier + EMA(previous day).

The Weighting Multiplier

The most recent price is given an 18.18 percent weighted via a 10-period exponential moving average. An 18.18 percent EMA is also known as a 10-period EMA. The most recent price is given a 9.52 percent weighting via a 20-period EMA (2/(20+1) =.0952). It’s worth noting that the shorter time period’s weighting is higher than the longer time period’s weighting. In reality, every time the moving average period increases, the weighting is cut in half.

You may use the moving average formula to convert a % to time periods and then enter that amount as the EMA’s parameter if you wish to utilise a certain percentage for an EMA:

- Time Period = (2 / Percentage) – 1

- 3% Example: Time Period = (2 / 0.03) – 1 = 65.67 time periods

EMA Accuracy

The formula for an EMA includes the EMA value from the preceding period, which includes the value from the EMA value before that, and so on. The current value is made up of a small percentage of each preceding EMA value. As a result, depending on how much historical data you utilise in your EMA calculation, the current EMA number will alter. In order to calculate a 100 percent accurate EMA, you need to start your calculations from the first day the stock existed and use every data point the stock has ever had. Although this isn’t always possible, the more data points you utilise, the more accurate your EMA will be. The objective is to achieve maximum precision while reducing calculating time.

The Lag Factor

The latency increases as the moving average lengthens. A 10-day moving average exponential will cling to prices and turn quickly after they do. Short moving averages are similar to speedboats in that they are quick to alter and manoeuvrable. A 100-day moving average, on the other hand, has a lot of historical data, which slows it down considerably. Longer moving averages are like ocean tankers in that they are sluggish to alter and slow to move. A greater and longer price movement is required for a 100-day moving average to change direction.

Simple vs Exponential Moving Average

Although there are distinct differences between simple and exponential moving averages, one is not necessarily superior to the other. Exponential moving averages have a shorter latency, making them more sensitive to current prices – and price movements. Simple moving averages will flip first, followed by exponential moving averages. Simple moving averages, on the other hand, are a genuine average of prices over a certain period of time. As a result, simple moving averages may be more suited to identifying levels of support and resistance.

The use of a moving average relies on the goals, analytical approach, and time horizon. To discover the optimum match, chartists should experiment with both forms of moving averages as well as other periods.

Lengths and Timeframes

The duration of the moving average is determined by the analysis goals. Short-moving averages (5-20 periods) are ideal for trading and short-term trends. Chartists interested in medium-term trends favour longer moving averages spanning from 20 to 60 periods. Moving averages of 100 or more periods are preferred by long-term investors.

Some lengths of moving average are more popular than others. Perhaps the most popular is the 200-day moving average. This is a long-term moving average due to its length. Next, for the medium-term trend, the 50-day moving average is widely used. The 50-day and 200-day moving averages are frequently combined by chartists. A 10-day moving average was once popular in the short term since it was simple to compute. The numbers were simply put together and the decimal point was shifted.

Trend Identification

Whether the moving average is simple or exponential, the direction of the moving average gives crucial information regarding pricing. A rising moving average indicates that prices are growing in general. A decreasing moving average means that prices are declining on average. A long-term moving average that is increasing indicates a long-term uptrend. A long-term moving average that is decreasing indicates a long-term downtrend.

Double Crossovers

Crossover signals may be generated by combining two moving averages. John Murphy refers to this as the “double crossover approach” in his book Technical Analysis of Financial Markets. One relatively short moving average and one comparatively long moving average are used in a double crossover. The period for the system is defined by the general length of the moving average, as it does with all moving averages. A short-term method would use a 5-day EMA and a 35-day EMA. A Moving Average strategy that uses a 50-day SMA and a 200-day SMA is considered medium-term, if not long-term.

When the shorter moving average crosses above the longer moving average, it is called a bullish crossover. A golden cross is another name for this. When the shorter moving average crosses below the longer moving average, it is called a bearish crossover. A death cross (sometimes known as a “dead cross”) is a symbol of death.

Moving average crossovers provide indications that are somewhat late. The system, after all, uses two lagging indications. The larger the latency in the signals, the longer the moving average periods. When a strong trend emerges, these signals are quite effective. In the absence of a strong trend, a crossover moving average strategy will create a lot of whipsaws.

A triple crossover approach, which uses three moving averages, is also available. When the smallest moving average crosses the two longer moving averages, a signal is created once more. 5-day, 10-day, and 20-day moving averages could be used in a basic triple crossover moving average strategy.

Price Crossovers

Simple price crosses may also be utilised to produce indications using moving averages. When prices rise above the moving average, a positive signal is given. When prices fall below the moving average, a negative signal is issued. The longer moving average establishes the tone for the overall trend, while the shorter moving average generates the signals. Only when prices are already above the lengthier moving average would one search for bullish price crossovers. Trading in sync with the larger trend would be the case.

If the price is above the 200-day moving average, chartists will only pay attention to signals when the price is above the 50-day moving average. A move below the 50-day moving average would obviously precede such a signal, but any bearish crossovers would be overlooked since the larger trend is up. A price rise and continuation of the larger uptrend would be signalled by a cross back above the 50-day moving average.

Conclusion

The benefits of utilising moving averages must be balanced against the drawbacks. Moving averages are lagging, or trend-following, indicators that are constantly one step behind the market. However, this isn’t always a terrible thing. The use of moving averages ensures that a trader is following the current trend. Despite the fact that the trend is your friend, securities spend a lot of time in trading ranges, rendering moving averages useless.

Moving averages will keep you in a trend, but they will also give you late alerts. Using moving averages, don’t anticipate selling at the peak and purchasing at the bottom. Moving averages, like other technical analysis techniques, should be used in combination with other related tools. Moving averages may be used to describe the general trend, and then the RSI can be used to determine overbought or oversold levels.

FAQs

Que.1 Which of the moving averages is the most significant?

Ans. Periods of Common Moving Averages

In stock trading, the 200-day moving average is very important. A stock is considered to be in a positive trend if the 50-day moving average of its price continues above the 200-day moving average.

Que.2 What does the term “moving average” indicate?

Ans. A moving average is a price indication that represents the average value of a stock’s price over time (i.e. 10 days, 50 days, 200 days, etc.) and is commonly displayed alongside the closing price.